Singapore’s private property market continued to slow down one year after the adjustments to Additional Buyer’s Stamp Duty (ABSD) rates were introduced in April 2023.

Furthermore, buyers have turned cautious and have pushed back their homebuying plans amid strong headwinds from slower economic growth. This has been further compounded by higher-for-longer interest rates and the higher cost of replacement homes.

Residential Home Prices

The All Residential PPI growth slowed to 0.9% q-o-q in 2Q 2024, down from the 1.4% q-o-q growth seen in 1Q 2024. The slower growth momentum was seen consistent across the board. Prices of non-landed properties increased by 0.6% in 2Q 2024, compared to an increase of 1.0% in the previous quarter.

Prices of non-landed properties in the Core Central Region (CCR) decreased by 0.3%, compared to the 3.4% increase in the previous quarter. Prices of non-landed properties in the Rest of Central Region and Outside Central Region increased by 1.6% and 0.2% respectively, compared to an increase of 0.3% and 0.2% in the previous quarter respectively.

For landed properties, prices rose at a more gradual pace of 1.9% in 2Q 2024, compared to the 2.6% increase in the previous quarter.

Affordability remains a top concern for homebuyers. Despite rising prices, nearly 4 out of 5 non-landed homes sold in 2Q 2024 were priced below $2.5 million, with many buyers compromising by choosing smaller home sizes in order to keep within this price range.

Chart 1: Residential Price Indices

Source: URA as of 26 July 2024, ERA Research and Market Intelligence

Transaction Volume

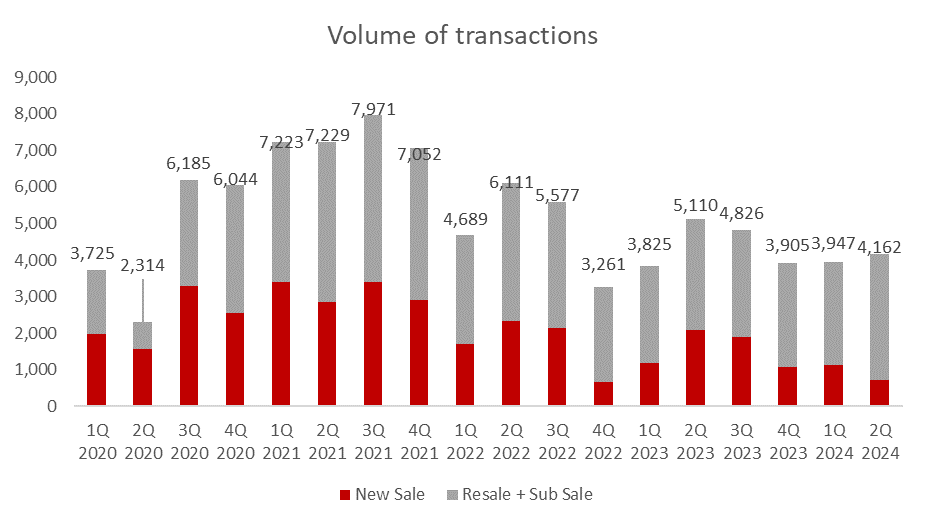

Based on URA caveats lodged, non-landed private property transactions have risen island-wide by 5.4% q-o-q to 4,162 units. However, this figure remains 18.6% lower than the same period last year.

On the back of fewer launches in 2Q 2024, new sale transactions fell by 37.7% q-o-q and 65.9% y-o-y, the lowest since 4Q 2022. With only 634 uncompleted private residential units (excluding ECs) launched, new sale transactions fell to 725 units in 2Q 2024.

Two of the launches that made their debut in 2Q 20224 were luxury developments, namely Skywaters Residences (190 units) and 32 Gilstead (14 units). They each sold at a median price of $6,100 psf and $3,455 psf respectively.

The combined transaction volume for resale and subsale non-landed properties rose by 41.4% q-o-q and 27.8% y-o-y.

The busier secondary market can be attributed to more housing options for buyers. Since 2003, we have seen almost 22,000 private homes completed to date. Consequently, these move-in ready homes appeal to sellers looking to time their property transactions to sidestep rental costs and ABSD.

Chart 2: All non-landed private residential transactions

Source: URA as of 25 July 2024, ERA Research and Market Intelligence

Unsold stocks rose by 3.2% q-o-q from 19,936 units in 1Q 2024 to 20,566 units in 2Q 2024. However, on an annual basis, this increase in unsold stock was more substantial, reaching 17.6%. The jump in unsold stock was largely due to the successive influx of new launches and buyers being more cautious due to cooling measures, economic uncertainty and the high interest rate environment.

CCR

Amongst the three regions, the CCR was the only one that witnessed a price decline of 0.3% q-on-q for non-landed properties in 2Q 2024. This reversal from the 3.4% increase of the previous quarter comes amid the lack of new home launches.

One year after the ABSD hike, the CCR market remains suppressed by a decrease in foreign buyers. While transaction volume jumped by 34.7% in 2Q 2024, this increase was mainly due to price adjustments at Cuscaden Reserve and The Residences at W Singapore Sentosa Cove that had boosted interest among Singaporeans.

RCR

For non-landed properties, RCR prices grew by 1.6%, the highest among the market segments. This growth was driven by RCR homes transacted in the secondary market, which was 35.7% more than the previous quarter. Homes in the city fringe still appeal to many local buyers with their close proximity to the downtown area and having amenities close by.

Prices of non-landed RCR homes have seen a significant 3.2% price growth y-o-y. As such, buyers who are priced out of homes in these areas may turn towards the HDB market, forgoing the chance to own a private property rather than the unit’s size or location. HDB flats transacted in some of these RCR locations have seen record-breaking prices for newer HDB flats as a result.

OCR

In the Outside Central Region, the number of transactions rose 32.3% y-o-y to 2,134 in 2Q 2024 compared to 1,613 in 2Q 2023.

The OCR region continue to be largely supported by homeowners and HDB upgraders who prioritise upcoming redevelopment and transport connectivity. They continue to make up the largest proportion of transaction ins 2Q 2024 accounting for 53.5% of all transactions. However, these buyers tend to be price sensitive and would typically buy within the sweet spot price quantum.

Ad2H 2024 Government Land Sale (GLS) Programmed Your Heading Text Here

To continue meeting housing demand and maintaining market stability, URA has released ten sites on the Confirmed List and nine sites on the Reserve List in the 2H 2024 GLS program.

On the Confirmed List, there are nine residential sites, inclusive of an executive condominium (EC) plot, and a residential and commercial plot. A total supply of 11,110 private residential units via the Government Land Sales Programme in 2024, the highest in a single year since 2013.

Outlook

Based on our observations, buying momentum for new homes is likely to pick up in 2H 2024 – especially with the upcoming launch of highly-anticipated new projects. These include SORA, Kassia, The Chuan Park and Emerald of Katong.

That said, affordability remains a top concern for today’s homebuyers. With upcoming rate cuts to be nowhere in sight, and rising economic uncertainty, buyers could be more prudent with their home purchases.

In view of higher new private home prices, some buyers may increasingly see better value in resale private units especially if location, size and amenities are critical purchase factors.

Among the regions, we expect the CCR to continue seeing muted demand, while RCR and OCR demand should hold steady with support from local buyers.

ERA projects the total resale transaction volume to reach between 26,000 and 27,000 units, with price to rise by 3% to 5% y-o-y in 2024. For new sale transactions, factoring current market conditions, ERA has revised our forecast to between 5,500 to 6,500 units by end-2024, a revision from the previous 7,000 to 8,000 units.